Mobisafar is a comprehensive platform offering a range of financial services, including AEPS (Aadhaar Enabled Payment System), money transfer, mobile recharges, and utility payments. It empowers both customers and agents by providing convenient access to these services, especially in remote areas. In this guide, we’ll explore everything you need to know about Mobisafar login, registration, customer care, app download, and more.

What is Mobisafar Login

Mobisafar Login refers to the process of accessing your Mobisafar account, which allows users to utilize a wide range of financial services such as money transfers, Aadhaar-enabled payments (AEPS), mobile recharges, utility bill payments, and more. Both customers and agents can log in to the Mobisafar platform to manage transactions and other financial activities.

How to Register on Mobisafar

To enjoy the full range of services provided by Mobisafar, you must first register on the platform. Below are the steps to complete the registration:

Step-by-Step Mobisafar Registration Process:

- Visit the Mobisafar Official Website: Go to mobisafar.com.

- Click on the ‘Register’ Option: You’ll find this on the top-right corner of the homepage.

- Fill in Your Details: You’ll be asked to provide your personal information, such as:

- Full Name

- Email ID

- Mobile Number

- Address

- Identification Documents (Aadhaar, PAN)

- Submit the Form: Once all details are filled in, submit the registration form.

- Verification Process: After submission, you’ll receive an OTP on your registered mobile number for verification. Enter the OTP to complete the registration.

- Mobisafar Login Credentials: Upon successful registration, you’ll receive your Mobisafar login credentials via email or SMS.

Mobisafar Agent Registration

Mobisafar offers individuals the opportunity to become agents and provide financial services in their locality. To register as a Mobisafar agent:

- Visit the Mobisafar Agent Registration Page: Click on the ‘Become an Agent’ option.

- Fill Out the Agent Form: Provide your professional details, including your shop/business information.

- Complete KYC Verification: Submit the required KYC documents for verification.

- Start Offering Services: After approval, you can start offering services through the Mobisafar portal.

Mobisafar Login

Logging into your Mobisafar account is simple and can be done via the website or mobile app. Here’s a step-by-step guide to help you access your account:

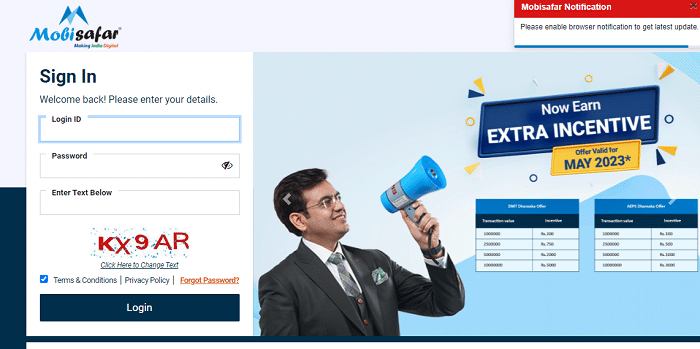

Mobisafar Login via Website

- Visit Mobisafar Website: Open your browser and go to mobisafar.com.

- Click on ‘Login’: You’ll find the login option at the top-right corner.

- Enter Your Credentials:

- Username: This is usually your registered email or mobile number.

- Password: The password provided during registration.

- Click on ‘Submit’: After entering your details, click submit to access your account.

Mobisafar Login via Mobile App

- Download the Mobisafar App: Go to Google Play Store or the Apple App Store and search for the Mobisafar app download.

- Open the App: Launch the app once it’s installed.

- Enter Your Login Details: Provide your username and password.

- Click ‘Login’: Access your Mobisafar account and start using the services.

| Login Method | Platform | Steps |

|---|---|---|

| Website Login | Browser | Visit site > Enter credentials > Login |

| App Login | Mobile App | Download app > Enter credentials > Login |

Mobisafar App Download: Features and Benefits

Mobisafar has a user-friendly app that makes it easier for customers and agents to access financial services on the go. Here’s how to download and use the app:

How to Download the Mobisafar App

- Open Google Play Store (Android) or App Store (iOS).

- Search for ‘Mobisafar’.

- Click ‘Install’.

- Once Installed, open the app and log in with your credentials.

Key Features of the Mobisafar App

- Easy Access to AEPS: Perform Aadhaar-based cash withdrawals and deposits.

- Money Transfers: Transfer money seamlessly between accounts.

- Mobile Recharge and Bill Payments: Top-up your phone or pay utility bills instantly.

- Transaction History: Keep track of your transactions in one place.

Benefits of Using the Mobisafar App

- Convenience: Access services anytime, anywhere.

- Secure Transactions: All payments are secured with encrypted protocols.

- Agent Support: Easy management of agent services for financial transactions.

Mobisafar Agent Portal

The Mobisafar agent portal allows agents to manage various financial services, including money transfers, AEPS transactions, and bill payments.

Features of the Mobisafar Agent Portal

- Dashboard Access: Agents can view all ongoing transactions and financial reports.

- KYC and Verification: Manage customer verification for seamless service.

- Agent Training: Access training material and customer support.

| Service | Description |

|---|---|

| AEPS | Aadhaar Enabled Payment System services for agents. |

| Money Transfers | Domestic money transfer services for customers. |

| Utility Payments | Electricity, water, and gas bill payments. |

| Mobile and DTH Recharge | Prepaid and DTH recharge services. |

Mobisafar Customer Care Number and Support

For any issues or queries, customers and agents can contact Mobisafar customer care.

Mobisafar Customer Care Number

- Customer Care Number: 1800-123-1212

- Email Support: support@mobisafar.com

Common Issues Handled by Mobisafar Customer Care

- Login Issues

- Failed Transactions

- Registration and Verification Help

- KYC Queries

Customer Care Timings

- Monday to Saturday: 9 AM to 6 PM

- Sunday: Closed

Services Offered by Mobisafar

Mobisafar provides a variety of essential financial services, catering to both agents and customers:

Aadhaar Enabled Payment System (AEPS)

- Cash Withdrawal: Customers can withdraw cash using their Aadhaar number.

- Balance Enquiry: Check your bank account balance linked to your Aadhaar.

Domestic Money Transfer

- Instant Money Transfers: Transfer funds from one bank account to another securely.

Utility Bill Payments

- Electricity Bill Payments: Pay your utility bills quickly through the Mobisafar platform.

Mobile and DTH Recharge

- Mobile Recharge: Recharge prepaid numbers for all major telecom operators.

- DTH Recharge: Easily top up your DTH services.

Conclusion

Mobisafar offers an efficient and accessible platform for both agents and customers to carry out a wide range of financial transactions. With its easy registration, secure login options, and customer support, Mobisafar simplifies financial services, particularly for those in rural or semi-urban areas. Whether you’re looking to use AEPS, transfer money, or become an agent, Mobisafar ensures that you have the tools to manage your financial needs efficiently.

Read More: Moinabad Farm House Dunduubhi Moinabad, Hyderabad

FAQs

What is Mobisafar?

Mobisafar is a digital platform offering financial services such as AEPS, money transfers, and bill payments.

How Can I Register on Mobisafar?

You can register on Mobisafar by visiting their website and filling out the registration form.

How Do I Log into My Mobisafar Account?

You can log into your account either through the website or the Mobisafar app by entering your registered mobile number or email and password.

What is the Mobisafar Customer Care Number?

The Mobisafar customer care number is 1800-123-1212.

How Do I Download the Mobisafar App?

You can download the Mobisafar app from Google Play Store or the Apple App Store by searching for ‘Mobisafar’ and clicking on the download option.